Solitaire Game Report Card (Part 2) – After the release of Disney Solitaire

From Candy Crush to Disney, big brands are reviving the genre, 336#

Hey Friends, Greetings from Bangalore 💗

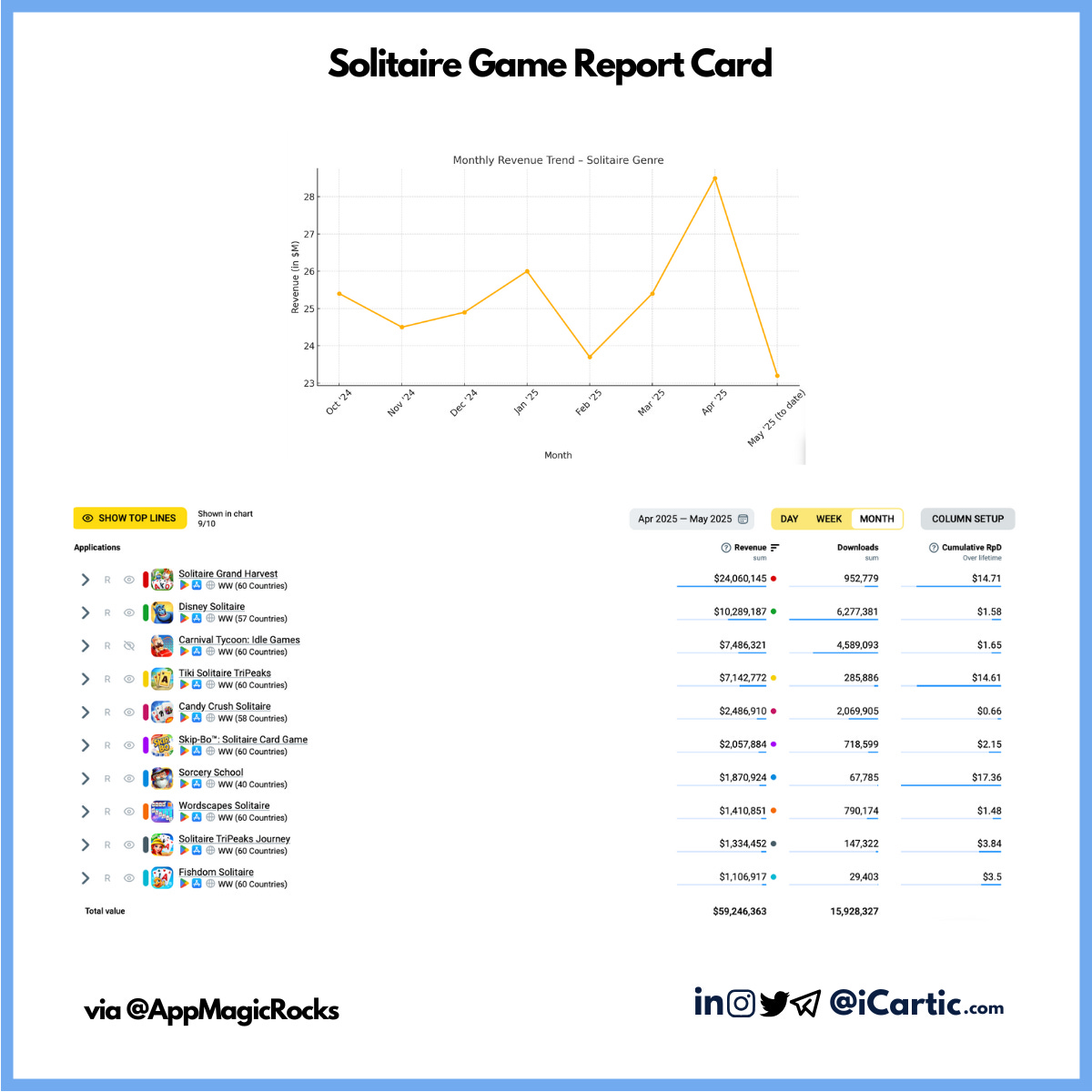

Disney Solitaire launched globally on April 17, 2025. Here’s the game report card compared against the genre performance.

Since launch, it has generated $10.2M in revenue and crossed 6.2M downloads, ranking #2 in revenue within the solitaire sub-genre.

Is the genre growing? Here’s the trend in monthly revenue:

May (to date): $23.2M

April: $28.5M

March: $25.4M

Feb: $23.7M

Jan: $26M (Q5)

Dec '24: $24.9M

Nov '24: $24.5M

Oct '24: $25.4M

Another big launch earlier this year?

Candy Crush Solitaire (Feb release), which pulled in $1.5M in revenue as of April 25. My earlier post on Candy Crush Solitaire and the genre performance after its release (Solitaire Game Report Card (Part 1))

Geo Revenue Split (April 2025) between Disney vs Candy Crush Solitaire:

Disney draws 48% from the US and strong presence in JP (12%)

King’s Candy Crush Solitaire leans heavily on the US (64%)

Disney Solitaire: 48% US, 12% JP, 6% UK, 5% DE & FR (each), 4% AU, 3% CA

Candy Crush Solitaire: 64% US, 6% UK, 5% DE, 4% CA, 3% FR, 2% AU & IT (each)

But in terms of lifetime monetization (RpD), Sorcery School still leads the chart:

Sorcery School: $17.36

Solitaire Grand Harvest (Playtika): $14.71

Tiki TriPeaks (Scopely): $14.61

Disney Solitaire: $1.58

Candy Crush Solitaire (King): $0.66

The genre is evolving fast, with new IPs and monetization models unlocking both scale and depth.

Disney’s entry confirms that even large IPs are betting on solitaire's evergreen appeal.

tCARe, CARtic P

/ iCartic.com